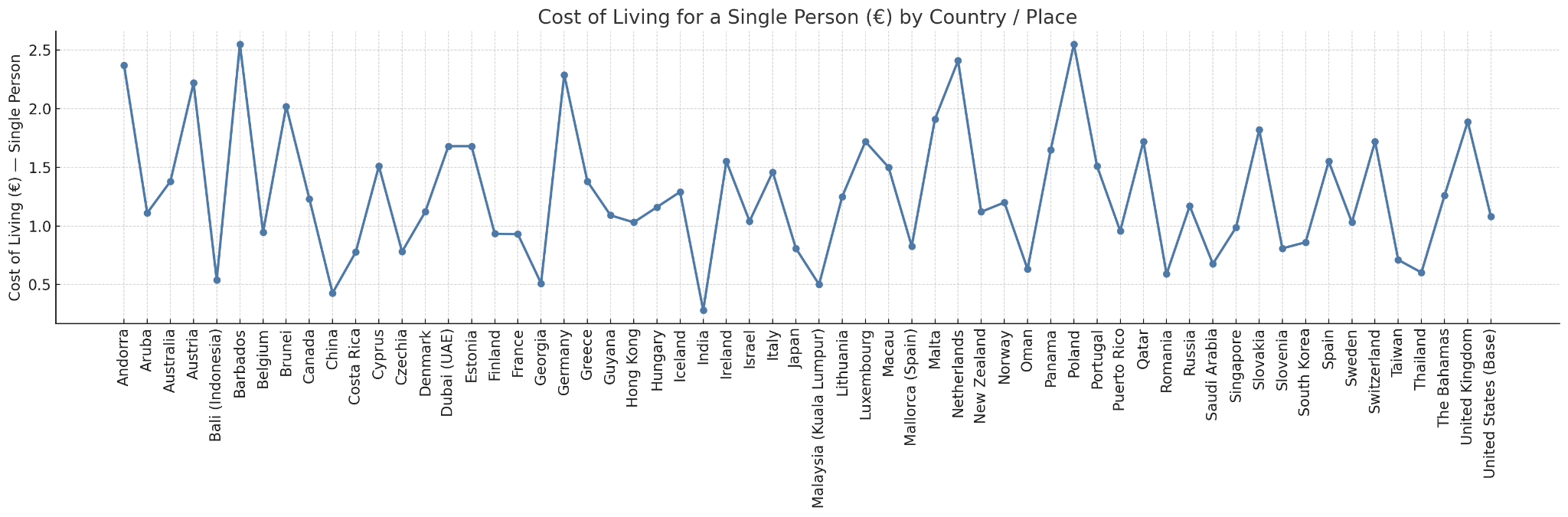

| Andorra | € 2.37 | € 3.91 | Above EU avg; 1-bed ≈ €1,300/mo; housing scarcity drives prices. | |

| Aruba | € 1.11 | € 3.99 | High import costs; small-island premium. | |

| Australia | € 1.38 | € 4.95 | OECD: strong house-price rise; rent slower. | |

| Austria | € 2.22 | € 4.64 | Mid-high EU; Vienna rents high. | |

| Bali (Indonesia) | € 539 | € 1.96 | Low vs West; tourist areas higher; 1-bed ≈ €900 Denpasar. | |

| Barbados | € 2.55 | € 5.10 | One of world’s most expensive (index ~123). | |

| Belgium | € 946 | € 3.39 | ≈ US parity; buying ↑ faster than rent. | |

| Brunei | € 2.02 | € 4.10 | High income; limited rental supply. | |

| Canada | € 1.23 | € 4.48 | Rent < ownership growth; city variation large. | |

| China | € 427 | € 1.59 | 55% below US; rent 75% lower; big city premiums. | |

| Costa Rica | € 776 | € 2.88 | 23% cheaper than US; rent −53%. | |

| Cyprus | € 1.51 | € 3.44 | Above Balkans; coastal property costly. | |

| Czechia | € 780 | € 2.65 | Prague 1-bed ≈ €900; ownership rising fast. | |

| Denmark | € 1.12 | € 3.44 | High cost (Eurostat 143 index). | |

| Dubai (UAE) | € 1.68 | € 3.87 | High urban rents; large expat premium. | |

| Estonia | € 1.68 | € 3.68 | Tallinn prices catching up with W. Europe. | |

| Finland | € 933 | € 3.44 | ~US parity; moderate housing increases. | |

| France | € 929 | € 3.34 | Paris 1-bed ≈ €1,720; regional gap wide. | |

| Georgia | € 510 | € 1.86 | Low cost (≈ −52% vs US); rents rising in Tbilisi. | |

| Germany | € 2.29 | € 4.26 | Above EU avg; sharp house-price growth post-2010. | |

| Greece | € 1.38 | € 3.10 | 2010–19 housing slump (−20 pts), now rebounding. | |

| Guyana | € 1.09 | € 2.80 | 67% cheaper than LatAm average. | |

| Hong Kong | € 1.03 | € 3.44 | One of world’s most expensive housing markets. | |

| Hungary | € 1.16 | € 2.92 | Index ~60 vs EU 100; Budapest rents ↑ fast. | |

| Iceland | € 1.29 | € 4.30 | OECD +41 pts (2019–24); very high cost. | |

| India | € 280 | € 989 | Index ~24 → ~75% cheaper than US. | |

| Ireland | € 1.55 | € 4.73 | Dublin 1-bed ≈ €2,000; top EU prices. | |

| Israel | € 1.04 | € 3.71 | 12% > US; Tel Aviv among highest global rents. | |

| Italy | € 1.46 | € 3.18 | 2010–19 house-price decline; now rising. | |

| Japan | € 808 | € 2.91 | −28.5% vs US; rent −65%. | |

| Malaysia (Kuala Lumpur) | € 500 | € 1.83 | Very low (index ~32); rent inexpensive. | |

| Lithuania | € 1.25 | € 2.67 | E. EU with fast growth; rent not included. | |

| Luxembourg | € 1.72 | € 5.59 | Eurostat 151 → most expensive EU; supply tight. | |

| Macau | € 1.50 | € 4.63 | Rent included; small, costly market. | |

| Mallorca (Spain) | € 826 | € 2.90 | Tourist-area prices high; Spain −20 pts 2010–19. | |

| Malta | € 1.91 | € 3.60 | Above EU avg; rent pressure from expats. | |

| Netherlands | € 2.41 | € 4.99 | Strongest EU house-price rise 2000–25. | |

| New Zealand | € 1.12 | € 3.45 | Big housing boom 2000–25; rents lag. | |

| Norway | € 1.20 | € 3.87 | High Nordic costs; Oslo expensive. | |

| Oman | € 630 | € 2.25 | ~40% cheaper than US; low housing cost. | |

| Panama | € 1.65 | € 3.32 | Mid-range; Panama City costly vs interior. | |

| Poland | € 2.55 | € 8.58 | Needs verification; actual cost likely ≈ €1,000 single / €3,000 family. | |

| Portugal | € 1.51 | € 3.18 | OECD +46 pts (2019–24); Lisbon/Porto high. | |

| Puerto Rico | € 956 | € 3.32 | ~8% cheaper than US; imports raise prices. | |

| Qatar | € 1.72 | € 3.87 | Expensive housing for expats; utilities cheap. | |

| Romania | € 589 | € 2.10 | Eurostat 57 index → cheapest EU; rents low. | |

| Russia | € 1.17 | € 2.17 | Index ~23 → among cheapest globally; rents very low. | |

| Saudi Arabia | € 676 | € 2.47 | 37% below US; housing moderate. | |

| Singapore | € 987 | € 3.62 | Rent 23% > Seattle; overall 5% < Seattle. | |

| Slovakia | € 1.82 | € 3.52 | Upper-E. EU; Bratislava near Vienna prices. | |

| Slovenia | € 808 | € 2.77 | Rent not included; moderate cost. | |

| South Korea | € 860 | € 3.01 | Seoul high; key-money system affects rents. | |

| Spain | € 1.55 | € 3.44 | Eurostat 98 index; Madrid 1-bed ≈ €1,450. | |

| Sweden | € 1.03 | € 3.27 | High Nordic; Stockholm expensive. | |

| Switzerland | € 1.72 | € 5.16 | World’s top cost (index ~126); very high housing. | |

| Taiwan | € 710 | € 2.60 | Rising property; Taipei pricey. | |

| Thailand | € 602 | € 1.81 | Index ~31 → very cheap; Bangkok higher. | |

| The Bahamas | € 1.26 | € 4.52 | High island costs; similar to Barbados. | |

| United Kingdom | € 1.89 | € 4.73 | London 1-bed ≈ €2,800; housing ↑ strongly 2000–25. | |

| United States (Base) | € 1.08 | € 3.61 | OECD +38 pts (2019–24); ownership much costlier than rent. | |